Wealth Management for Dummies

Wiki Article

Top Guidelines Of Wealth Management

Table of ContentsWealth Management Can Be Fun For EveryoneSome Known Details About Wealth Management How Wealth Management can Save You Time, Stress, and Money.8 Easy Facts About Wealth Management DescribedExcitement About Wealth Management

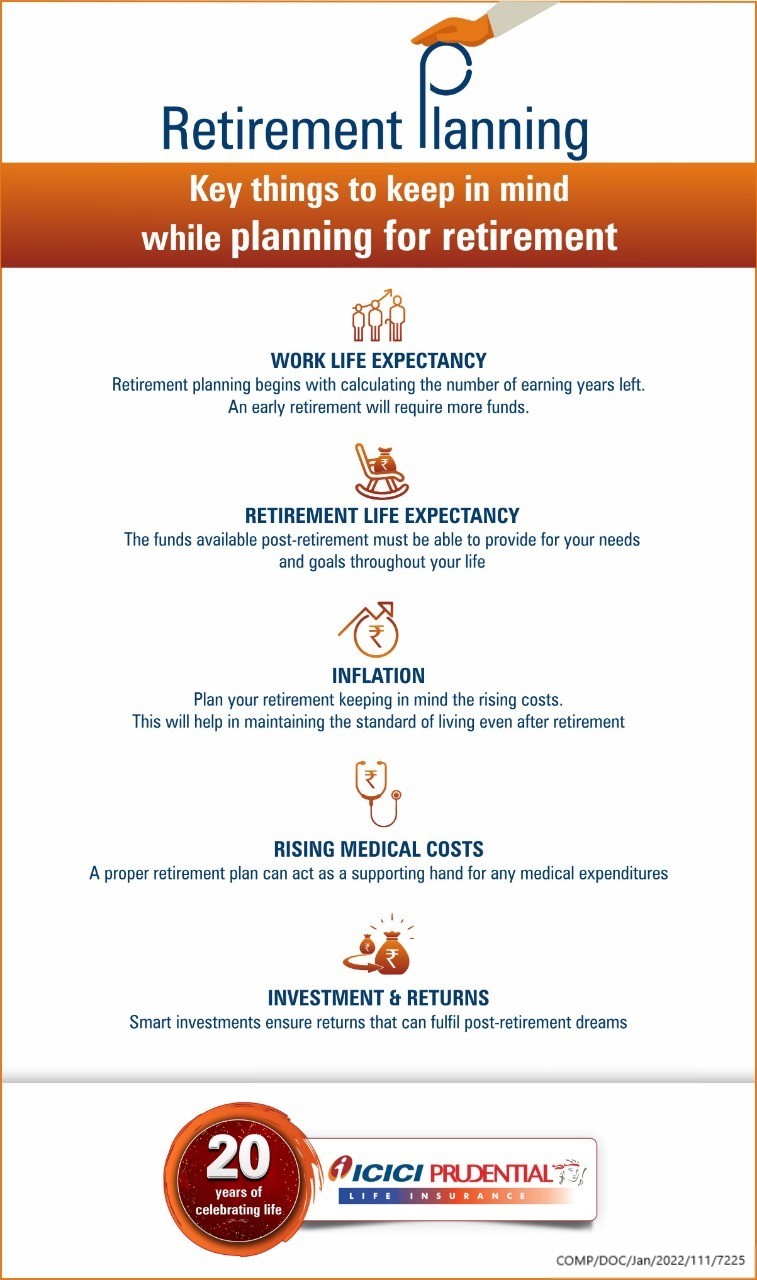

The non-financial elements consist of way of living options such as exactly how to hang around in retirement, where to live, and when to quit functioning completely, to name a few things. An alternative approach to retired life planning takes into consideration all these areas. The emphasis that one puts on retirement preparation adjustments at different phases of life.

Others claim most retired people aren't saving anywhere near enough to meet those standards and should change their way of life to live on what they have. While the amount of money you'll wish to have in your savings is necessary, it's also an excellent concept to take into consideration all of your costs.

Fascination About Wealth Management

And also considering that you'll have more downtime on your hands, you may additionally intend to consider the price of enjoyment as well as travel. While it might be tough to come up with concrete figures, make certain ahead up with a reasonable price quote so there are not a surprises later on.

Despite where you remain in life, there are several essential steps that put on practically everybody throughout their retired life planning. The adhering to are a few of the most typical: Come up with a strategy. This includes deciding when you wish to start conserving, when you desire to retire, as well as exactly how much you would certainly such as to save for your supreme goal.

Check on your financial investments every now and then and also make routine modifications. It's constantly an excellent concept to make any type of changes whenever there's a change in your way of life and also when you go into a click to read more various stage in your life. Pension can be found in many sizes and shapes. The rules and also guidelines for every might be different.

You can and also need to contribute greater than the quantity that will earn the company suit. In reality, some professionals recommend upwards of 10%. For the 2023 tax obligation year, participants under age 50 can contribute up to $22,500 of their revenues to a 401( k) or 403( b) (up from $20,500 for 2022), several of which may be in addition matched by an employer. description wealth management.

The 9-Minute Rule for Wealth Management

The typical specific retired life account (IRA) allows you place apart pre-tax dollars. This implies that the cash you save is subtracted from your income before your taxes are obtained. Thus, it lowers your gross income as well as, for that reason, your tax obligation responsibility. If you're on the cusp of a higher tax bracket, buying a traditional individual retirement account can knock you to a lower one.When it comes time to take distributions from the account, you are subject to your common tax rate at that time. Maintain in mind, though, that the money grows on a tax-deferred basis.

Roth IRAs have some limitations. The contribution limit for either IRA (Roth or typical) is $6,500 a year, or $7,500 if you are over age 50. Still, a Roth has some income limits: A solitary filer can contribute the total only if they make $129,000 or less each year, since the 2022 tax obligation year, and also $138,000 in 2023.

The Ultimate Guide To Wealth Management

The BASIC INDIVIDUAL RETIREMENT ACCOUNT is a pension used to employees of tiny businesses instead of the 401( k), which is costly to preserve. It functions similarly a 401( k) does, allowing staff members to conserve money automatically with payroll deductions with the choice of an employer match. This amount is topped at 3% of a staff member's yearly wage.Catch-up contributions of $3,500 enable employees 50 or older to bump that limitation approximately $19,000. As soon as you set up More Help a pension, the question becomes just how to route the funds. For those intimidated by the supply market, take into consideration buying an index fund that requires little upkeep, as it merely mirrors a supply market index like the Criterion & Poor's 500.

Below are some standards for effective retired life preparation at different phases of your life., which is an important as well as beneficial item of retirement cost savings.

Also if you can only deposit $50 a month, it will certainly be worth three times extra if you invest it at age 25 than if you wait to start spending till age 45, thanks to the happiness of intensifying. You could be able to spend more money in the future, yet you'll never be able to make up for any lost time.

Wealth Management Can Be Fun For Everyone

Nevertheless, it's critical to continue saving at this phase of retirement planning. The combination of gaining more cash and also the time you still need to spend as well as gain rate of interest makes these years several of the most effective for hostile financial savings. People at this stage of retired life preparation must remain to capitalize on any 401( k) coordinating programs that their employers supply.Report this wiki page